New Supply Maintains Healthy Balance

By Beth Mattson-Teig | Wealth Management Real Estate’s 7th Annual Industrial Survey

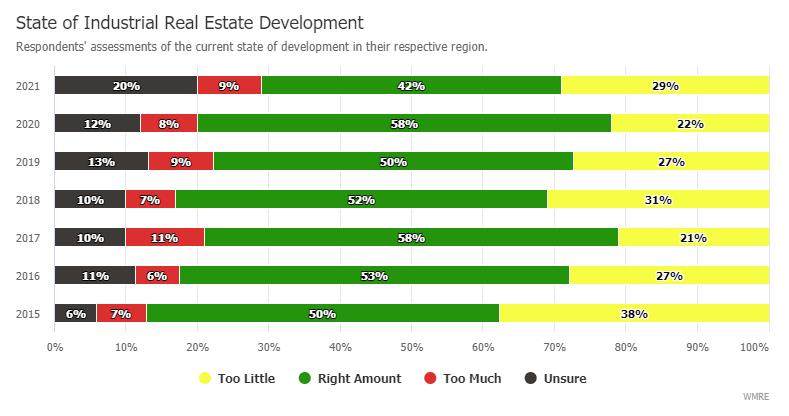

The majority of respondents are also not worried about over supply. Those who think there is “too much” development occurring have remained in the minority for the past five years with a range of 7 percent to 11 percent, including 8.6 percent in the current survey. More respondents (42 percent) view the volume of new development occurring as the “right amount,” while those who think there is “too little” being built climbed from 22 percent in 2020 to 29 percent in this year’s survey.

According to Cushman & Wakefield, new supply totaled 352.9 million sq. ft. in 2020—a 5.7 percent increase compared to 2019. In addition, the firm was tracking 397.1 million sq. ft. of space under construction as of the first quarter of 2021.

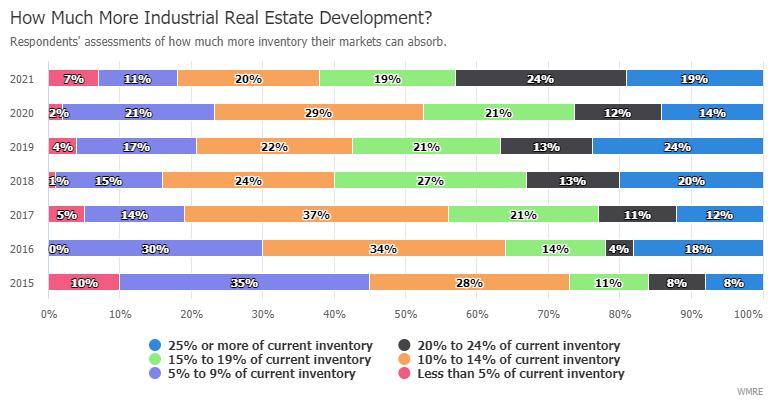

Views were mixed on how much new supply their respective markets could absorb. Overall, 43 percent believe their markets could absorb 15 percent to 24 percent more new supply, while 38 percent said less than 15 percent of current inventory and 19 percent predict that their market could absorb more than 25 percent.

Mohr Capital is one firm that is planning to double its industrial development in 2021 with about 4.5 million sq. ft. of construction starts. The developer builds bulk warehouse facilities that it typically sells after securing leasing commitments from long-term, single net lease tenants. The group is developing a 7.5 million-sq.-ft. industrial park in suburban Indianapolis. They recently broke ground on a new 827,000-sq.-ft. spec bulk warehouse project at the Mohr Logistics Park. That project comes on the heels of a recently completed 1 million-sq.-ft. facility at the park that was fully leased to Cooper Tire & Rubber Co.

“The industrial market did take a pause last year, and everybody thought it was going to take a little bit longer to come out of the pandemic and turn around. But the industrial market is probably as hot as it’s ever been,” Bob Mohr, founder and chairman of Mohr Capital, a Dallas-based privately held real estate investment firm.

Read Bob Mohr’s thoughts on current industrial demand and why this sector was one of the star performers throughout the pandemic in “New Supply Maintains Health Balance” and “Debt Remains Available.”